The objective was to leverage machine learning to enhance credit risk assessment and help lenders make informed decisions. By alerting them to potential risks, we aimed to improve the entire process. Our data science team developed and deployed a loan default model to assist loan processors in assessing default probabilities.

By analyzing data entered by loan applicants, our model provides an efficient and reliable scoring mechanism. This enables the client to evaluate creditworthiness more accurately. Furthermore, deploying the model via API has become a valuable solution for financial institutions, improving their ability to assess credit risk.

Through machine learning techniques and seamless integration with existing loan application systems, lenders can now accurately score loan default probabilities. This case study underscores the role of data science in improving credit risk assessment. It also highlights Mutually Human’s commitment to delivering innovative solutions that drive positive outcomes for our clients.

To build the loan default model, we gathered loan application data, credit history, financial details, and other relevant information. We then took the following actions:

including cleaning, normalization, and feature engineering, to prepare the data for analysis.

Using a machine learning algorithm, we trained the model on a labeled dataset, evaluating its performance through several accuracy metrics including accuracy, precision, recall, and F1-score.

For our loan default model, we selected a gradient boosting algorithm because of its ability to handle complex relationships and deliver accurate predictions. Next, we conducted feature selection and assessed the importance of various factors to identify those most influential in predicting loan defaults. Through rigorous training and validation, the model achieved high performance. As a result, it demonstrated a strong ability to distinguish between borrowers likely to default and those who are not.

The loan default model was deployed via API, providing our customer a seamless interface to score the probability of loan defaults in real-time. The API allows for efficient data input and preprocessing, ensuring that loan applicant data is handled securely and accurately. By leveraging the model’s predictions, our client is able to make more informed lending decisions, reducing credit risk and improving loan portfolio management. The implementation of the API resulted in increased efficiency, accuracy, and consistency in credit risk assessment processes.

For our loan default model, we selected a gradient boosting algorithm due to its ability to handle complex relationships and provide accurate predictions. Feature selection and importance assessment were conducted to identify the most influential factors for loan default predictions. Through rigorous training and validation, the model achieved a high level of performance, demonstrating its ability to effectively distinguish between borrowers likely to default and those who are not.

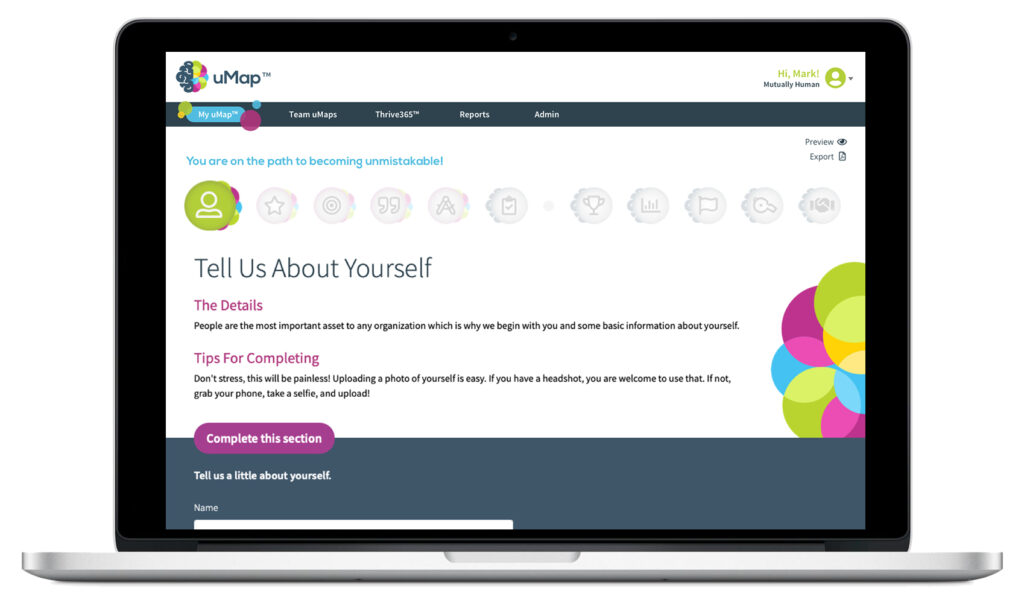

In the past, companies looking to purchase the uMap™ tool had to talk to the BU sales team. Now, companies ready to use this powerful tool can purchase the uMap™ tool online. The software walks the purchasers through an easy onboarding process to get them from purchase to up-and-running in very little time!

Creating a uMap™ is simple, yet very informative and inspiring. Each employee is guided through a series of questions that tap into both their professional and personal self.

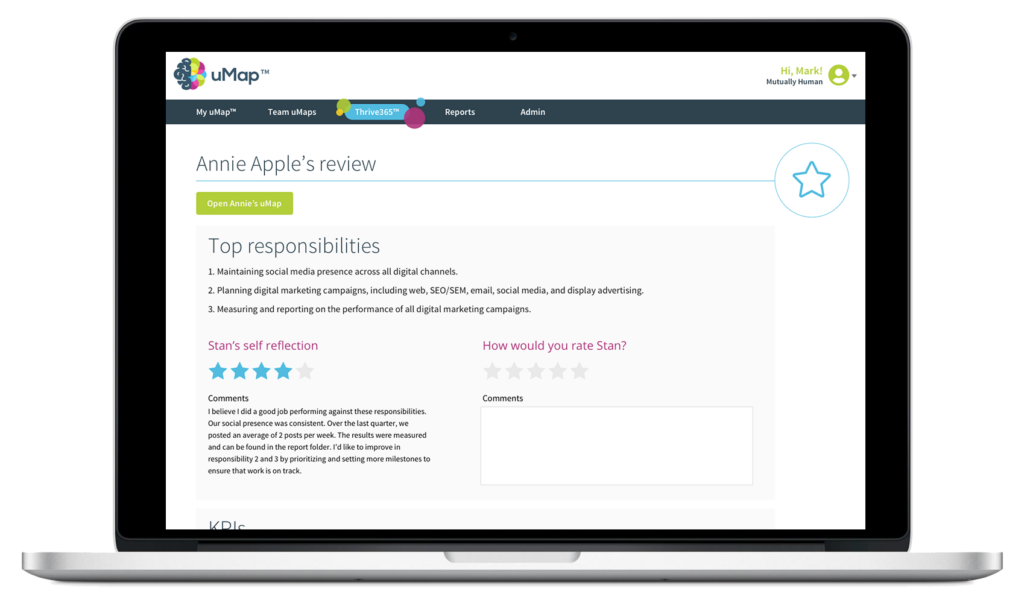

The uMap™ software comes complete with features allowing managers to complete a review process using each employee’s unique uMap™.